The History of Gold and Its Future – AurusGOLD (AWG)

The history of gold is the history of money. Gold has maintained its purchasing

Share article:

Famed playwright George Bernard Shaw once said that "if all economists were laid end to end, they would not reach a conclusion." Economists often study the same amount of data and develop downright divergent conclusions.

Case in point, the gold standard. Most economists oppose the tethering of a central bank's processes with an explicit monetary rule such as the gold standard. In 1924 John Maynard referred to the gold standard and gold by proxy as “a barbarous relic”.

A 2012 study by the University of Chicago Booth School of Business shows that 66% of economists are against the gold standard. Moreover, they oppose the opinion that replacing the US discretionary monetary scheme with a gold standard would provide better outcomes for the economy.

However, the graduate business school data shows that 34% of economists agree that defining the USD by distinct ounces of gold would provide higher employment and price stability metrics for the average American.

MIT Institute's professor Daron Acemoglu for instance, disagrees with the superiority of the gold standard. He, however, agrees that "a gold standard would have avoided the policy mistakes of the 2000s."

Stanford Graduate School of Business professor Edward Lazear also disagrees with the proposal but quips, "The gold standard adds credibility when a country lacks discipline. The cost is monetary policy flexibility. The tradeoff is unclear in the US."

Supporters of the gold standard include Chicago Booth's economics professor Austan Goolsbee. He supports the standard, saying that there are new gold reserve discoveries in store. Additionally, ongoing developments in extraction technology could increase the standard's feasibility.

MIT economics professor Bengt Holmström disagrees with the gold standard, saying that all data from past and present economic crises go against the convertibility of fiat to gold. He, however, seems to straddle both divides of the debate noting that gold is a safe haven asset and its current popularity has "little to do with US inflation." Gold is popular because it is an age-old acceptable store of value.

The History of Gold

The history of gold is the history of money. Gold has maintained its purchasing power over time, and it is synonymous with the history of wealth. The precious yellow metal's durability, rarity, and malleability have turned into the ancient and modern world’s symbol of status, wealth and power.

The history of gold is the history of money. Gold has maintained its purchasing power over time, and it is synonymous with the history of wealth. The precious yellow metal's durability, rarity, and malleability have turned into the ancient and modern world’s symbol of status, wealth and power.

The ancient Egyptians, for instance, used it to plate the capstones of their pyramids. Then in 3,100 BC, the early dynastic period’s pharaoh Menes incorporated gold into the ancient kingdom's economy. The code of Menes states that “one part of gold is equal to two- and one-half parts of silver in value”.

Around 600BC, Lydia, a kingdom that lay in modern-day Turkey, minted silver and gold alloy coins. The usage of the alloy referred to as electrum, then spread to Persia under Darius 1. Darius 1 and King Alyattes of Lydia stamped these minted coins with pictures that would denote diverse denominations. Darius passed the death penalty for any governor who would smelt and mint their precious metal coins. Soon, other regions in Europe, such as Rome, Greece and Carthage, embraced gold as a medium of exchange and store of value. Rome adopted the use of gold as money in 300 BC and minted the Aureus two and half centuries later. The aureus was ancient Rome's basic gold monetary unit. A denarius aureus was equal to 25 silver denarii.

After the fall of Rome, European culture integrated gold as money right into the Middle Ages. 14th century England used the gold coin, Noble, the Italians, the Florin, the Germans the Augustalis and Venetians the Ducat.

By the 17th century, merchants hoarded their gold deposits in royal mints and private goldsmiths. Goldsmiths would issue ownership receipts and would later re-lend this gold trading in receipts in exchange for lower fees.

It is the prototype of fractional reserve banking and the inspiration behind AurusGOLD (AWG). The Aurus Ecosystem mints gold crypto tokens and stores AurusGOLD (AWG) ownership data on the ultra-secure Ethereum blockchain's distributed ledgers instead of issuing paper receipts. Its golden token has a 1:1 backing by a gram of gold.

The Rise and Fall of the Gold Standard

The modern age's 1792 US coinage act created the US dollar and the United States mint. Major global economies adopted the ‘classic’ gold standard in 1879, with the UK defining the pound sterling's relativity to gold by 1816.

The modern age's 1792 US coinage act created the US dollar and the United States mint. Major global economies adopted the ‘classic’ gold standard in 1879, with the UK defining the pound sterling's relativity to gold by 1816.

However, the gold standard inconvenienced the superpowers during the war era. As a result, they would abandon the standard to finance the 20th-century war, and the UK would later fully leave it in 1931.

The USA first left the gold standard in 1944 after the Great Depression. Economists such as Ben Bernanke and Barry Eichengreen blame the gold standard for the lengthy decade-long depression period.

They say that adherence to the "barbarous relic” held back the expansion of the US money supply that would have stimulated the economy and funded government deficits and insolvent banks.

However, the Austrian Economic Theory supports the use of the gold standard. Austrian economics proponents state that governments would not have inflated the value of money as they have if it was still tethered to the supply of gold.

They blame the abandonment of the gold-backed currencies for the ongoing global financial market instabilities that continue to plague the world with no end in sight. The convertibility of money to gold would lower economic uncertainty, fix exchange rates and reign in runaway inflation.

When the US finally went off the gold standard, the Federal Reserve initiated a money creation process expanding the country's money supply. However, weakening global confidence in the dollar, deflation, and slow economic growth led to creation of the 1934 Gold Reserve Act, which ordered all commercial banks to surrender their gold reserves to the Fed. Instead, they would receive gold certificates, and Federal Reserve notes against their deposits.

The act, however, had adverse effects on the value of the dollar. In January 1934, the president devalued the dollar's value by 40%. Before the act, one dollar was worth $20.67. Afterwards, the convertibility of the USD to gold dropped to a $35 value.

The 1944 Bretton Woods agreement adhered loosely to the gold standard eliminating tenets such as the domestic convertibility of fiat to gold. Most countries replaced gold's role in their financial systems with the weakened dollar. They established the International Monetary Fund to oversee convertibility rates and the fiat exchange process.

However, in 1971, following the “Smithsonian Agreement", the dollar underwent another bout of devaluation. Its convertibility to gold dropped from $35 to $38 per troy ounce. Then in 1973, the government changed this value to $42.22 and in 1976 altered the definition of the USD. The US government eliminated references to the previous yellow metal from the law.

The constant devaluing of the dollar and rising inflation have dramatically affected fiat currencies. For example, the Federal Reserve’s M2 dollars stock rose from $15.34 trillion in early 2020 to $18.72 trillion by September 2020. Therefore, the Fed printed close to 18% or $3.38 trillion of its total dollar supply in months as a response to the Covid-19 pandemic's effects on the economy. As a result, the dollar in 1913 had 26 times more value than the dollar in 2020.

Gold as an Acceptable Store of Value

Central banks are acutely aware that money has no value. In 2011, American politician and activist Ron Paul asked the then-Fed chairman Ben Bernanke why central banks hoarded gold. After careful consideration, the anti-gold standard economist blamed the stockpiling of gold in government vaults on ''long term traditions''.

"So, people still think it's (gold) money", Ron Paul clarified.

The Fed, for instance, has over 8,133 tonnes of gold in its reserves held at Fort Knox, Denver Mint, Philadelphia Mint, West Point Bullion Depository and the San Francisco Assay Office.

In 2021, central banks worldwide purchased 463.1 tonnes of gold, an 82% year-on-year increase in gold reserves expansion. The World Gold Council states that central banks have been steadily hoarding more gold in their reserves since the 2008 economic crunch.

Their holdings have ballooned by 5,692 tonnes in 12 years, growing to a 35,600 tonnage by 2022. If gold were a barbarous relic, central banks would not have such a bullish view of the metal a century after John Maynard Keynes's remark.

However, a better reason to hold gold coins and cryptocurrency backed by gold and silver is the adverse effect of inflation on savings. To illustrate this point, Germany's Bundesbank holds the second-highest amounts of gold reserves after the Fed. It has over 3,362 tonnes of gold in its vaults.

German citizens, however, hold more gold in their homes, bank safety deposits and third-party vaults than their central bank. They collectively own over 8918 tonnes of gold. Unlike Chinese and Indian gold buyers that purchase gold due to various cultural influences, Germans invest in gold due to their experience and fear of inflation and recessions.

Memories of the 1923 Weimar republic inflation period bring back memories of when senior citizens lost their entire investments and savings overnight. Today, 38% of German citizens own gold in coins or bars, while 61.5% own gold in jewellery form. Then, 14.5% of German adults own gold in formats such as ETFs and gold-based cryptocurrency.

Most German buyers kicked off their gold purchase strategies after the 2008 recession to safeguard their savings against currency fluctuations. However, 61% of German gold investors say that, unlike paper money, gold will not lose its longer-term value.

Gold Stablecoins - The AurusGOLD Solution

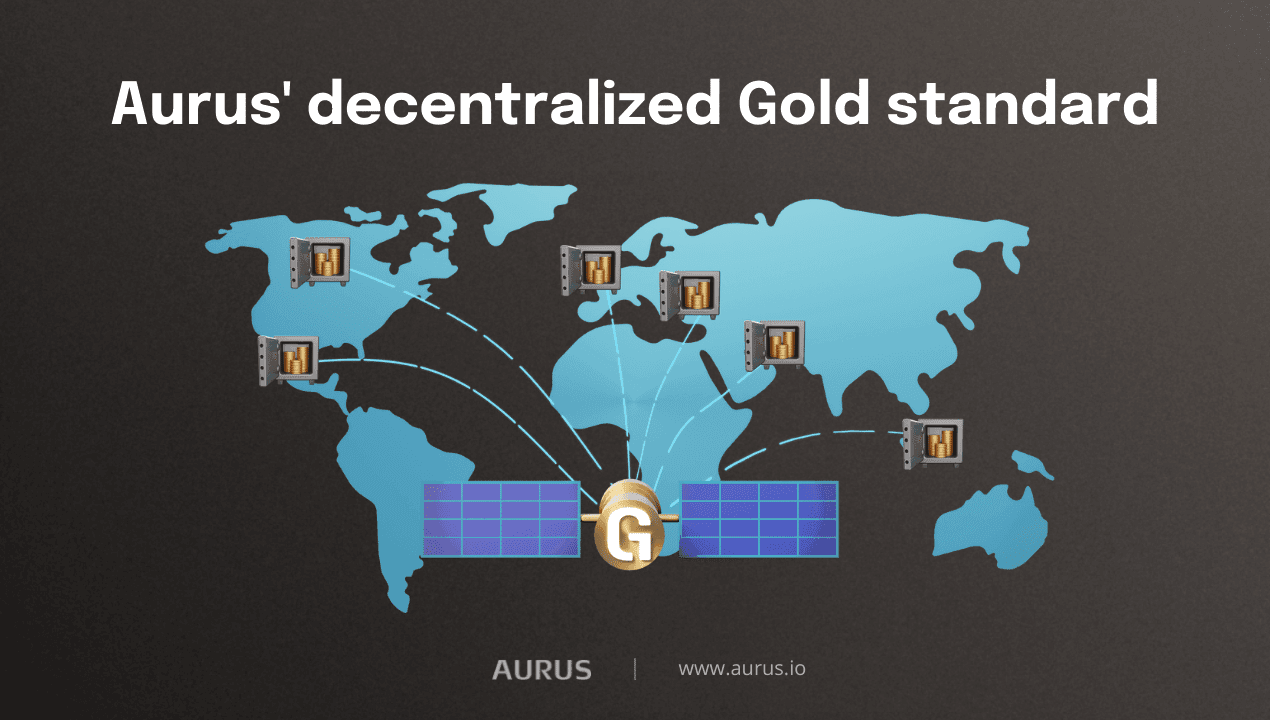

AurusGOLD (AWG) is a gold-backed token with a decentralised bullion storage infrastructure via a global network of partnered Vaults. Aurus has brought gold to the blockchain sector by creating a gold standard crypto ecosystem decentralised via the Ethereum and Polygon blockchains.

AurusGOLD (AWG) is a gold-backed token with a decentralised bullion storage infrastructure via a global network of partnered Vaults. Aurus has brought gold to the blockchain sector by creating a gold standard crypto ecosystem decentralised via the Ethereum and Polygon blockchains.

Consequently, while AurusGOLD (AWG) is not the first crypto pegged to gold, its competitors, such as Pax Gold (PAXG), Tether Gold (XAUT), Cache Gold (CGT) and Kinesis, either have a centralised storage system (which increases the single point of failure risk) or do not use a decentralised token infrastructure.

In contrast, Aurus, in partnership with its Vault Partners in regions such as Canada, Zurich, Singapore, Texas, London and Istanbul, stores its bullion in various locations globally, effectively lowering idiosyncratic risks.

Aurus's decentralised protocol protects investors from various financial and natural disasters and enhances credibility and trust amongst AurusGOLD (AWG) holders. Aurus’s decentralised gold standard token is fully backed by 1 gram of vault secured gold, creating a stabilised digital currency with the potential to neutralise the world's current financial problems. Furthermore, the tokenization of gold eliminates all prior inefficiencies that gold carried as physical currency and eliminates the vulnerabilities of the fiat monetary system.

Aurus’s decentralised gold standard token is fully backed by 1 gram of vault secured gold, creating a stabilised digital currency with the potential to neutralise the world's current financial problems. Furthermore, the tokenization of gold eliminates all prior inefficiencies that gold carried as physical currency and eliminates the vulnerabilities of the fiat monetary system.

A potent use case is AWG's hedge against economic downturns. Stocks, commodities, and ironically cryptocurrencies are extremely volatile and, therefore, a poor hedge against inflation.

As valuable as gold is, as an edge against inflation, most willing investors cannot purchase it due to fundamental shortcomings such as its poor portability and fungibility metrics. Furthermore, physical gold bullion is easy to counterfeit, difficult to transport, and no longer legal tender. The Aurus Ecosystem mints tokenized gold via blockchain technology.

Its gold backed digital currency is perfect for use in disrupted and hyperinflated economies like Venezuela, where the people desperately need a reliable and stable monetary system. AWG tokens can ensure that its holder's assets maintain their purchasing power now as they will in 50 years, rather than lose half in value every 52 days.

Preserve your purchasing power and start stacking Gold (AWG) today via the Aurus Mobile App.

Follow Aurus: Website | Twitter | Telegram | LinkedIn | Youtube | Newsletter