How Gold Tokenization Is Transforming the Financial Industry

From paper-based gold certificates to blockchain-powered gold-backed tokens. Discover how gold tokenization is transforming the financial industry.

Share article:

The global financial markets are highly fragmented and inefficient due to the limitations of low counterparty trust. Consequently, investors and traders have to jump over hurdles such as minimal access to liquidity and investment opportunities. Investors must also overcome restraints such as underdeveloped market standards and multi-day settlement cycles.

Fortunately, blockchain-based innovators such as Aurus have solutions to these challenges and are revolutionizing the financial industry. Aurus is a game-changing tokenization-as-a-service platform that seeks to address market fragmentation within the precious metals sector.

Aurus' protocol facilitates the tokenization of gold, silver, and platinum, offering investors easy access to the physical precious metal ownership via the Aurus mobile app. For instance, this platform's tokenized gold or gold-backed crypto tokens empowers investors to purchase minute quantities of gold affordably, transparently, and efficiently.

Cryptocurrency backed by gold and silver makes precious metal investments easily accessible and expands the sector's potential client base.

Moving From Manual to Digital Trust

Do you know that the $100,000 Gold Certificate is the United States government's largest issue of paper currency notes? The US government first issued this note in 1934. It is, however, not your ordinary dollar note but a gold certificate issued under the March 3, 1863, US Banking Act.

Gold certificates are bills or paper notes given by the government representing their holder's claim to a dollar value of gold bullion or gold in the United States Treasury. Gold certificates were either large or small currency notes per their denominations.

Small-sized gold certificates denominated quantities as low as $10 or $20 worth of gold. Governments issued gold certificates as a convenience. For instance, the $100,000 Gold Certificate was only used in money transfers between the Federal Reserve Bank and/ or financial institutions.

Gold certificates were easier and safer to transport than bulky gold bullion. Additionally, these certificates were instruments of trust, restoring trust in paper currency whenever the private bank-issued paper money lost its value.

That said, gold certificates also had a variety of shortcomings such as forgeries, overissue, accidental double printing, or occurrence of circulating but replaced certificates. Moreover, a faulty gold certificate could deny its holder access to an equivalent amount of gold held within the most secure vault in the world.

Gold certificates exchanged hands alongside their paper counterparts till the gold standard ended. Then, in 1934, President Roosevelt asked all American citizens to turn in their gold certificates for paper currency or silver coins, ending the gold coin and certificate era.

Today, gold certificates are proof of ownership, issued when you deposit gold in banks. These paper proofs of ownership are legal tender, and you can redeem them for their face value in paper or coin currencies at any financial institution.

Today, gold certificates are proof of ownership, issued when you deposit gold in banks. These paper proofs of ownership are legal tender, and you can redeem them for their face value in paper or coin currencies at any financial institution.

These certificates are also trust-building tools and are easier to handle and exchange than bulky gold. A few gold refiners also provide gold certifications for their bars.

Authenticity and ownership certificates are synonymous with most financial industry processes. Securities investors, for instance, also receive paper certificates as proof of ownership. Traders circulated these paper certificates around to new stock owners in an ultra-slow process that was risky and expensive.

Technological advancements in the financial industry have led to the dematerialization of these certificates. The elimination of the cumbersome paper-based trust-building process through electronic bookkeeping has lowered risk, brokerage fees, and delayed transactions.

Today, most securities trade via central security depositories (CSDs) that immobilize paper certificates and store all value in one secure location. Consequently, physical securities certificates have gone out of fashion thanks to investor CSD accounts and electronic book entry.

What Is Tokenization?

Gold-backed cryptocurrencies explore further benefits of dematerialization and technology through tokenization. Tokenization is a process that converts ownership rights into a digital format. Tokenized gold functions like a gold ownership certificate on secure, transparent, and auditable decentralized ledger technology (DLT) or blockchain.

Tokenization is the next generation of electronic book entry, using digital tokens to represent the value of tangible assets on the blockchain. Tokenization can be applied to physical assets including commodities, real estate, fine art, and collectables, as well as intangible assets such as equities, copyrights, licenses, Intellectual Property (IP), and patents.

The Aurus protocol specializes in the tokenization of precious metals including gold, silver and platinum. tGOLD (tXAU) is a gold-backed cryptocurrency that represents real physically allocated gold bullion stored in the most secure vault in the world. Having the backing of a stable tangible asset considers tGOLD as a stablecoin, which is convertible to real-world gold.

Blockchain enforces entirely decentralized transfer and accounting processes. Consequently, a horde of nodes or network participants verifies and validates tokenized gold ownership heightening these digital certificates' security, trust, transparency, and immutability.

Benefits of Gold Tokenization

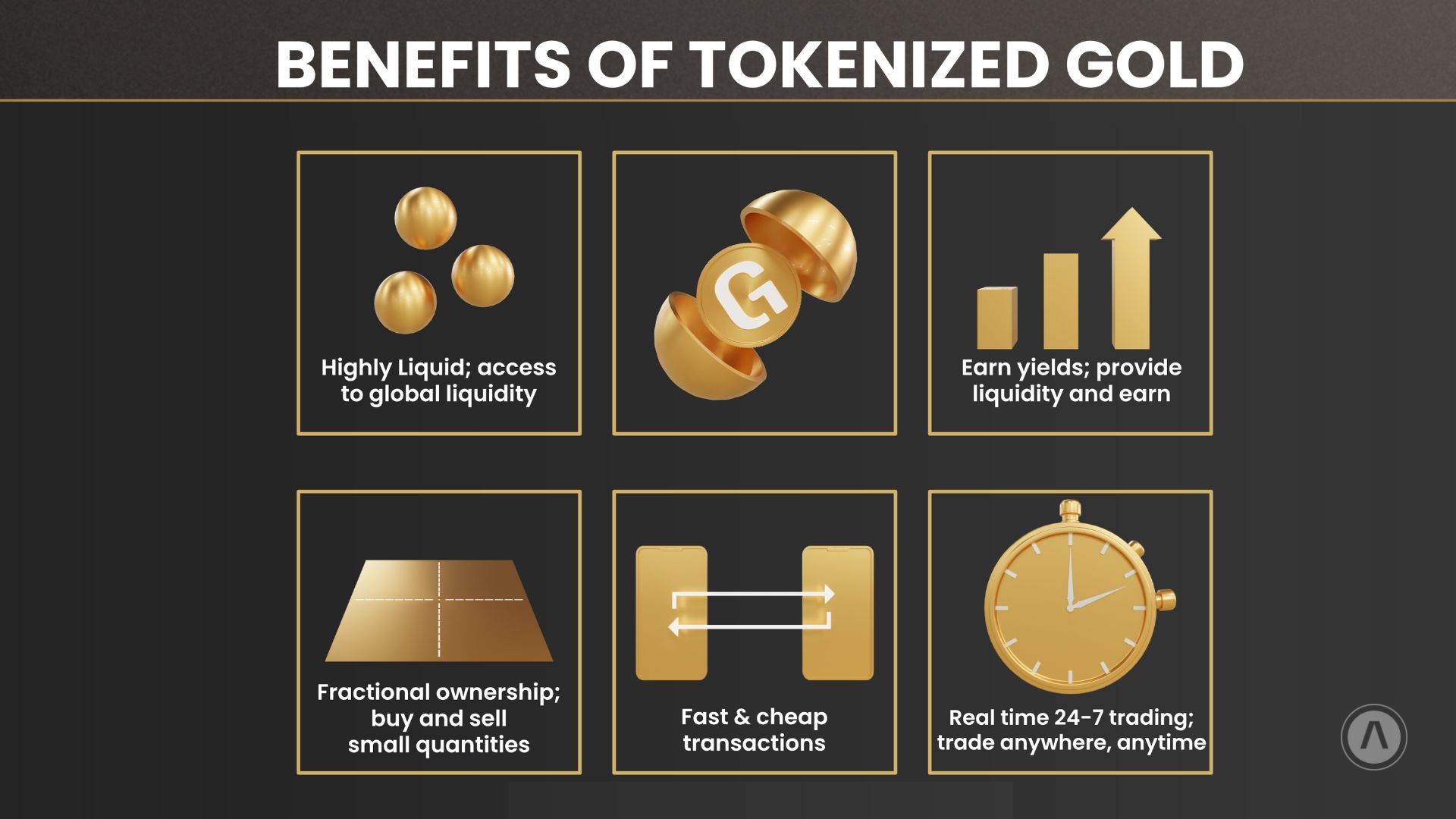

- Unprecedented liquidity – Crypto pegged to gold through tokenization gives typically illiquid asset token issuers access to greater liquidity.

- Fractional ownership – Tokenization supports fractional ownership of assets. For example, if you do not have adequate funds to purchase an ounce of gold, you can buy a gold-backed cryptocurrency, own a portion of an ounce, and affordably benefit from the gold market's potential price gains.

- Fast & Cheap transactions – Gold-backed crypto transactions are faster and cheaper than traditional transactions.

- Enhanced transparency – You no longer need to hold a gold certificate of ownership. Neither do you need to fret about authenticity certificates since tokenization processes create a transparent and easy audit data trail through all supply chain stages.

- Increased accessibility – Tokenized precious metals trading is convenient and allows any person to have exposure to the markets through open blockchain ledgers and platforms.

- Reduced intermediaries – Blockchain technology creates immutable records of transactions mitigating counterparty risks in gold trading.

- Yield opportunities – Investors can benefit from the widespread usage of Aurus gold-backed tokens via the Aurus ecosystem token AurusX (AX), to receive ongoing rewards in tGOLD, tSILVER and tPLATINUM tokens.

How Gold Tokenization Transforms the Financial Industry

Tokenization has the potential to make the financial industry more accessible, cheaper, faster and easier, thereby possibly unlocking trillions of dollars in currently illiquid assets and vastly increasing the volume of trades.

Gold tokenization has a variety of benefits in the financial industry. Financial institutions such as JPMorgan are tokenizing gold via the Ethereum network. These large financial industry players are driven into tokenization by the knowledge that the tokenization of commodities is the new normal in the financial world.

Tokenization supports the atomic settlement or the instant exchange of two linked assets. You could, for instance, instantly receive your gold tokens, or swap directly against other crypto assets in decentralized exchange trading pools such as tGOLD:tSILVER (Gold:Silver). You no longer have to endure the two-plus days wait that traditional assets transfers take to settle if you trade metal-backed blockchain tokens.

Then, blockchain technology's smart contracts can automatically execute a transaction as per a sequence of processing steps eliminating any need for intermediaries. Smart contracts ease the gold investment processes through their trustless systems.

Third-party free transactions are highly transparent and have higher traceability. Fraudsters cannot influence the integrity, purity, or price of gold whose value is tokenized and stored in ultra-safe vaults. Smart contracts also eradicate any errors in the transaction process.

Third-party free transactions are highly transparent and have higher traceability. Fraudsters cannot influence the integrity, purity, or price of gold whose value is tokenized and stored in ultra-safe vaults. Smart contracts also eradicate any errors in the transaction process.

Programmable gold that leverages interoperable token standards is easily transferable across vast networks and exchanges, creating new value chains for tokenized gold. Interoperable token standards allow investors to trade the same digital representation of gold from any part of the world 24/7.

Additionally, tokenization introduces new financial institution roles in this value chain. For example, a financial institution could act as a consultant, supporting precious metal businesses that wish to tokenize their bullion reserves.

On top of that, tokenization will open up the gold sector's private markets. It will unlock the potential within this illiquid sector, home to one of the best-performing asset classes of the century.

This process would add new liquidity to the markets and improve settlement efficiency. In addition, tokenizing gold will eliminate gold trading counterparty risks, lower complex financial assets reconciliation costs and automate compliance, reporting, and asset servicing.

Conclusion

The Aurus ecosystem's tokenized precious metal tokens are the ideal investment vehicle for the precious metal market. They are fully transferable, highly secure, liquid, and divisible and are proof of full ownership of underlying gold stored in the safest vaults in the world.

Be a part of the gold-backed digital currency investment movement via Aurus gold-backed tokens and enjoy all the benefits tokenization offers the savvy investor.

Follow Aurus: Website | Twitter | Telegram | LinkedIn | Youtube | Newsletter