AurusGOLD as a Stable and Rare DeFi Primitive

Aurus supports the creation of DeFi primitives built on gold's rare qualities

Share article:

A common argument amongst many gold bugs is that gold is money because it is scarce. These gold aficionados paint an apocalyptic vision of an age where gold buyers will endure endless queues to purchase negligible amounts of the precious yellow metal.

In that scary future, money has no value, and gold demand will exceed its supply due to mine depletion. In addition, there are also murmurs of gold production hitting its peak production, further stoking fears of falling gold supplies.

Some pundits have warned that gold miners have discovered almost all of the world's most significant deposits. Therefore, these gold maximalists warn that minimal gold deposits are left to uncover. As a result, miners struggle to align reserves growth with production costs, they say.

True to their word, gold deposit discoveries have declined in the last three decades. Most mining companies have pumped billions of dollars into exploration. Still, they have not come across the highly coveted 5 million ounces of gold reserves that can yield at least 250,000 ounces of precious metal.

As per the U.S. Geological Survey (USGS), gold miners have discovered over 244,000 metric tons of gold. The planet's underground historical production is 187,000 metric tons.

The world's most prolific gold mining regions include South Africa, Australia, and China. Miners from these regions excavate about 4000 to 5000 metric tons of gold annually, adding it to the existing stockpile.

In 2021, gold mines produced 4,666 tons of precious metal. Gold jewelry production absorbs about half of all freshly mined gold each year.

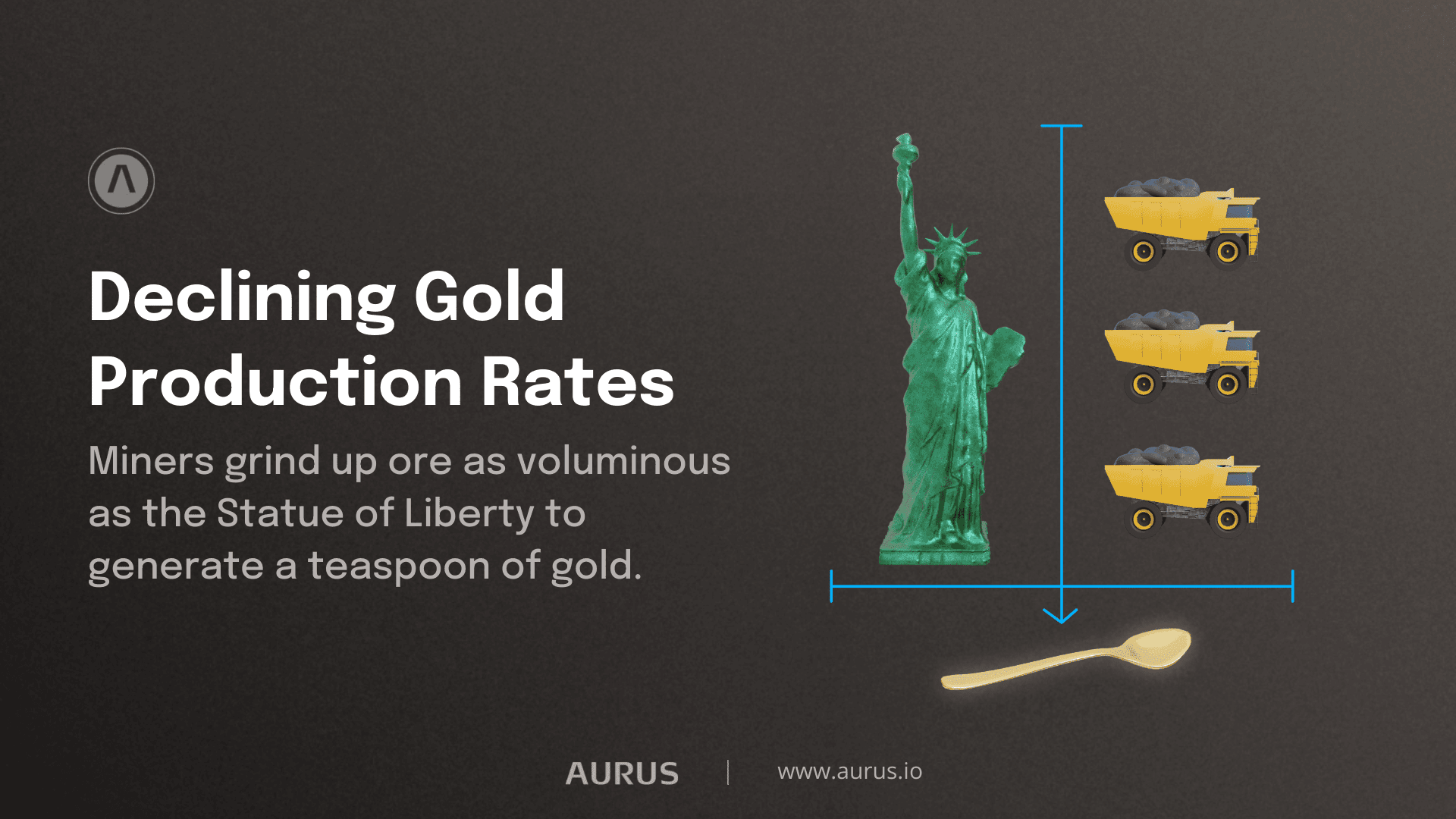

Data also shows that mining grades are falling, and production costs have increased by a third in the last decade. The 1960's gold mine produced at least 10 grams per ton of ore mined. Today, a ton of ore will barely yield a gram of gold. Most mines' production is lower than 1.4 grams of gold per ton of ore.

For descriptive purposes, the Newcrest Cadia East mine in Sydney, regarded as one of the world's most profitable mines, has an ore grade that provides 0.45 grams of gold per ton of ore.

Consequently, miners grind up ore as voluminous as the Statue of Liberty to generate a teaspoon of gold. There is fear, therefore, that in the future, the grade of ore will become so poor and yield so little that gold mining will not be economically feasible.

Based on known reserves, estimates suggest that gold mining could reach the point of being economically unsustainable by 2050.

Based on known reserves, estimates suggest that gold mining could reach the point of being economically unsustainable by 2050.

To this end, many mining firms consolidate their operations through acquisitions and mergers to present healthy portfolios to investors.

"Given the lengthy amount of time required to explore, discover, delineate, permit, finance, and build a new mine, merger and acquisition is a much faster way to replace reserves," says Ryan Hanley, a Laurentian Bank Securities analyst.

Gold production is a reflection of price

As per the USGS data above, at least 57,000 metric tons of yellow ore discovered by mining companies have not undergone production. Consequently, 20% of all discovered gold deposits are still intact, awaiting production.

Experts, however, say that gold deposit estimations are a moving target. Gold discovery is hinged on the price of gold and the production of new technologies that ease gold extraction.

To illustrate this point, at least 60% of all gold mining operations occur on surface mines. Consequently, underground mines that could yield more precious metals only produce 40% of all freshly mined gold. And while it is true that low-cost mining in older mines in Australia and South Africa has become more unproductive, Latin America, Canada, and West Africa have unexplored gold mining potential.

Then, there could be massive gold deposits in extreme habitats such as Antarctica and the ocean floor. The proliferation of AI, robotics, big data, and smart data mining technology could make large-scale mining in extreme physical and weather conditions less capital intensive and feasible.

Therefore, gold mining will increase when gold prices support more exploration activities. "There is no shortage of gold in the world, but just at this price, there is a shortage. So (when) gold is maybe $2,000 per ounce, you will see a rush of exploration and more deposits being found," says John Ing, an analyst at Maison Placements Canada.

Gold is a stable measure of monetary value.

Consequently, rather than invest in gold due to poorly backed supply shortage fears, investors should understand the precious metal’s age-old stability as a measure of value. Since the dawn of commerce, gold and silver have been the basis of money.

These precious metals are a historical measure of monetary value, and civilization has relied on them since 550 BC. Speaking on the importance of gold and silver, fourteenth-century Arab philosopher, sociologist, and historian Ibn Khaldun wrote, "And God created the two precious metals, gold, and silver, to serve as the measure of value of all commodities. … For other goods are subject to the market fluctuations, from which they are immune."

This statement by the Middle Ages scholar portrays why gold is the best portfolio diversification asset of all time. Gold is not the basis of money merely because it is scarce but because of its stability. Moreover, it has underpinned most of the world's dominant economic policies for centuries because of its unchanging characteristics.

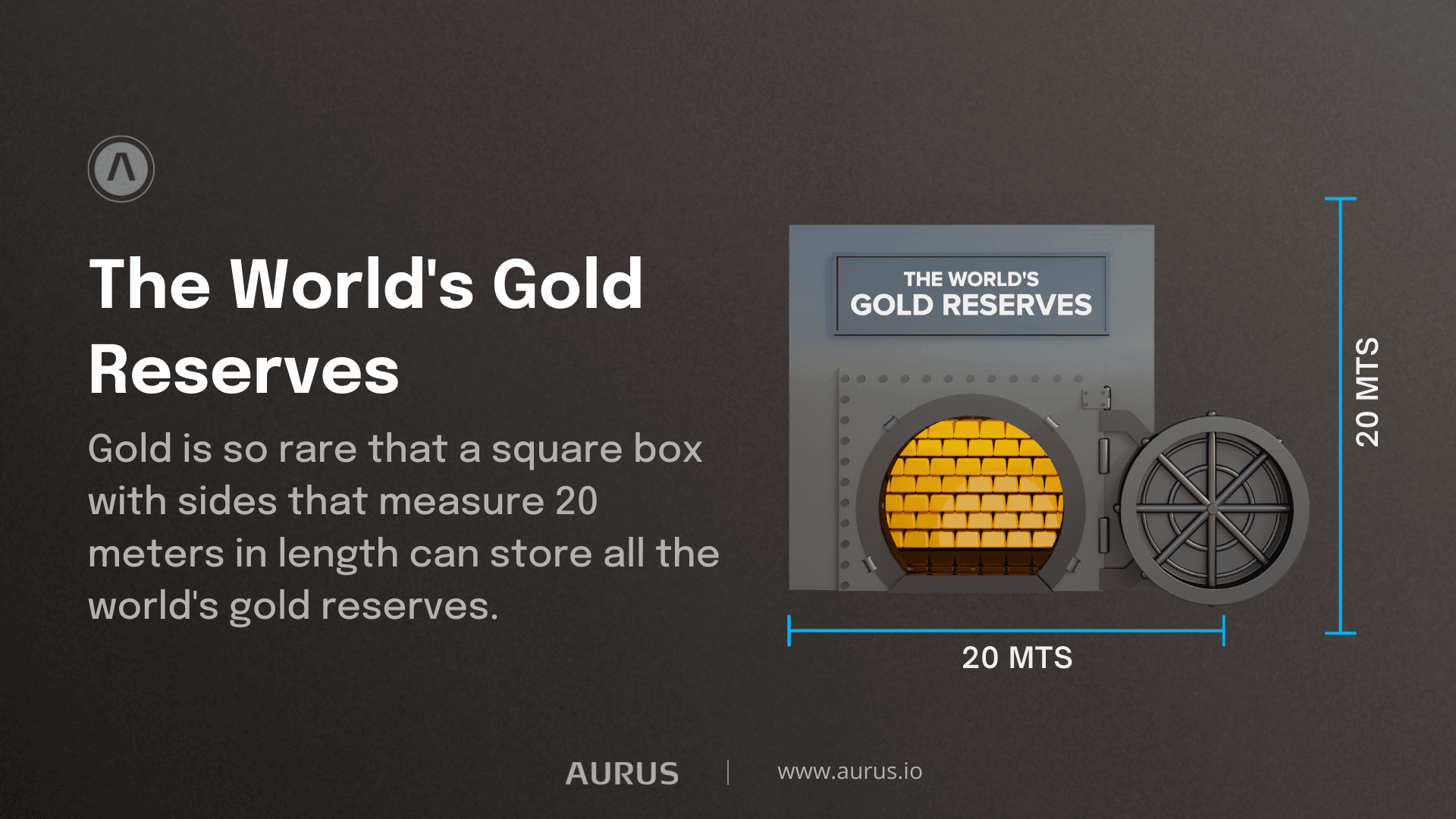

First, gold is one of the most impactful and valuable minerals because it bears the stable qualities that other rare metals lack. It is so rare that a square box with sides that measure 20 meters in length can store all the world's gold reserves.

Then, gold has a hefty atom configuration that even high pressure and heat conditions of the supernovae chemical forges that produce most chemical elements will not yield its quality. Its weight gives it easily provable validity.

Tungsten is heavy, but it is brittle and hard. To this end, gold is a dense repository of value that is distinctive and has a supply limitation. Then, while the periodic table has 118 elements, few of them are as suitable for coinage as gold.

Mercury may be as dense and heavy, but you would need a vessel to move mercury from one place to the other. Moreso, a fluid currency is not as transportable as solid metals are. Then most fluids react to a variety of chemical and physical conditions.

Silver may tarnish over time due to its reactivity to Sulphur compounds in sweat. On the other hand, gold does not rust, tarnish or acquire unsightly splotches. It is inert to alkaline, acidic, and bacteria solutions.

To damage gold, you would need aqua regia or King's water, an acidic solution. Then gold is so safe for human use that bakers are happy to incorporate it into their fancy pastries as an edible garnish. Yet despite gold's heavyweight, it is also deceitfully malleable and soft. The precious metal is so soft that you can beat one gold gram into a square metal-wide sheet, or drawn to 2.4 km wire.

One other unique quality that makes gold so desirable is its rare coloration. Its golden hue is inimitable. It is the only elemental metal that bears this golden hue.

While pyrite, bronze, and brass alloys could pass for gold, they are not soft. Consequently, you can validate a gold coin's authenticity by simply biting into it. Your teeth can put a dent on gold because it has a Mohs hardness scale of 2.5, while teeth have a 5 rating. So gold is safe, rare, portable, and distinctive.

And while it is no longer the medium of exchange in the global economy, like money, it does not have other utilitarian purposes. To this end, commerce will eventually deplete finite minerals such as oil, but gold reserves will remain stable for decades.

The electronics sector and other industrial applications only use 10% of mined gold. Most gold piles in bullion and jewelry form have accumulated in this format since antiquity. Most gold utilized in electronics also undergoes recycling and is therefore never lost.

Gold is also a much better store value than fiat currencies as it is not subject to inflation. In 1923 Germany, hyperinflated banknotes became wallpaper, kids’ playthings, and furnace fuel.

Gold will, however, maintain its expensive price tag because of its high cost of production. Therefore, it will remain a stable, everlasting store of value. It is also a permanent measure of value whose accumulation and reserves will grow steadily over time as the existing fiat-based monetary arrangements slip into anarchy due to inflation.

AurusGOLD as a scarce DeFi primitive

DeFi primitives are the basic components of decentralized finance (DeFi) applications. They include protocols, smart contracts, decentralized exchanges (DEXes), and other platforms that enable the construction of financial applications on the Ethereum blockchain.

Primitives are important because they provide the building blocks for DeFi applications. Without them, developers would have to start from scratch to create each new application. This would be slow and expensive. With primitives in place, developers can focus on creating new applications and features, rather than on building the infrastructure.

Primitives also make it possible for users to access a wide range of DeFi applications in one place. Rather than using different exchanges, wallets, and protocols for each application, users can access them all through a single interface. This makes DeFi more user-friendly and increases its adoption.

There are a variety of DeFi primitives available, each with its own advantages and use cases. Decentralized exchanges, for example, offer users a way to trade cryptocurrencies without having to trust a central party. Smart contracts enable the development of complex applications such as lending and borrowing platforms. And protocols like 0x provide the infrastructure for building decentralized exchanges.

You can find DeFi primitives on a variety of Ethereum-based platforms, including MetaMask, Gnosis Safe, Argent, and others. These platforms provide developers with the tools they need to build DeFi applications. They also offer users a convenient way to access and use those applications.

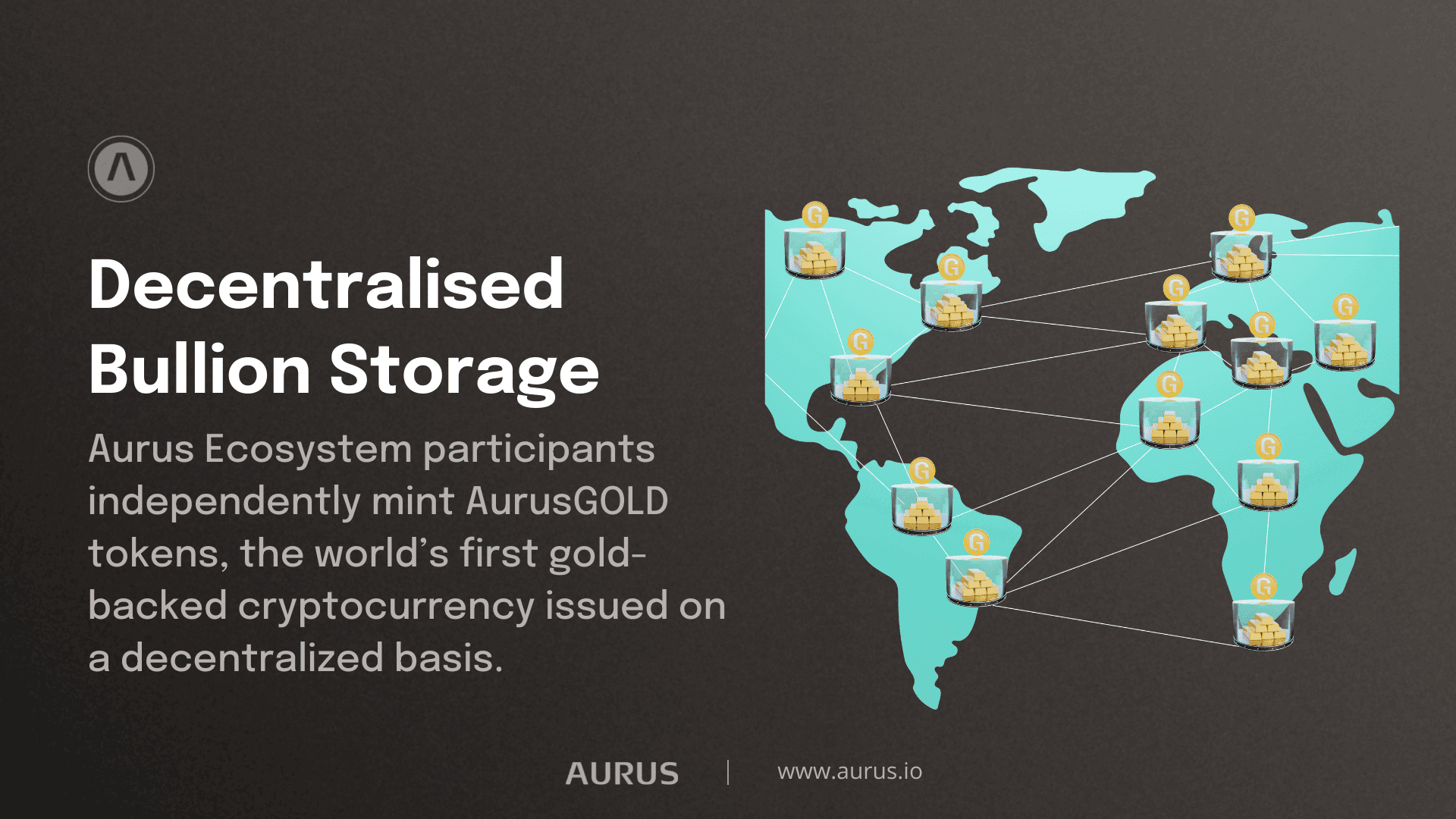

For these reasons, the Aurus Ecosystem supports the creation of decentralized finance (DeFi) primitives built on the rare qualities of gold. The AurusGOLD (AWG) DeFi primitive is a Decentralized Bullion Storage Network (DBSN) that runs on the Ethereum and Polygon blockchain networks. Aurus Ecosystem participants independently mint AurusGOLD (AWG) tokens, the world’s first gold-backed cryptocurrency issued on a decentralized basis.

For these reasons, the Aurus Ecosystem supports the creation of decentralized finance (DeFi) primitives built on the rare qualities of gold. The AurusGOLD (AWG) DeFi primitive is a Decentralized Bullion Storage Network (DBSN) that runs on the Ethereum and Polygon blockchain networks. Aurus Ecosystem participants independently mint AurusGOLD (AWG) tokens, the world’s first gold-backed cryptocurrency issued on a decentralized basis.

Aurus is a scarce DeFi primitive that can support the deployment of gold-based decentralized finance applications, NFTs, play-to-earn, and metaverse projects that exploit gold's stable, predictable, and consistent nature.

Aurus protocols tokenize physical gold bullions using London Bullion Market Association (LBMA) certified gold deposits. As a result, projects that build on the Aurus ecosystem will have stable bullion assets backing their NFTs or tokens rather than ultra-volatile crypto assets or low-value governance tokens.

AurusGOLD also poses as an excellent stablecoin since it is backed by stable gold deposits stored in decentralized storage facilities. Furthermore, Aurus' gold-backed cryptocurrency protocol will increase the accessibility of gold investing through tokenization protocols. Aurus' gold crypto tokens can enhance DeFi projects sustainability, security, reliability, value, and capital efficiency in the DeFi 2.0 era, by being used as DeFi primitives.

Follow Aurus: Website | Twitter | Telegram | LinkedIn | Youtube | Newsletter