Ecosystem token

Passive rewards in gold, silver and platinum.

Benefit from the growth and trading activity of the Aurus ecosystem with AurusX (AX).

AurusX (AX) - the ecosystem rewards token

AurusX (AX) is the Aurus ecosystem token that can be staked to earn rewards in tGOLD, tSILVER, and tPLATINUM, as well as vote on proposals governing Aurus.

Why hold AurusX?

3 simple reasons

Earn rewards from the trading activity of precious metals

Vote on ecosystem proposals

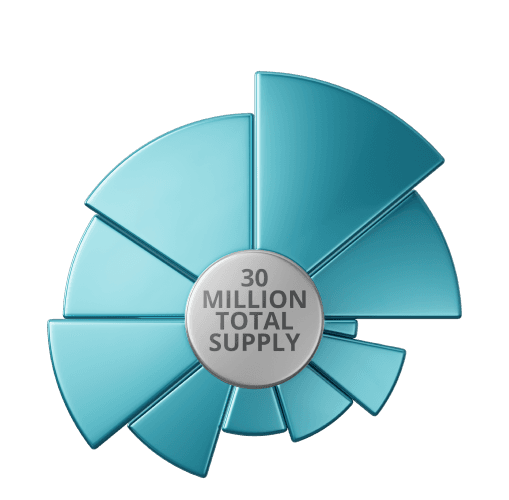

AurusX is a scarce digital asset

How do AurusX rewards increase?

The Aurus ecosystem comprises precious metals providers, vaults, and dealers that produce and distribute precious metals tokens (tGOLD, tSILVER, tPLATINUM) globally. As these tokens are minted, transferred, and burned, they produce fees as follows: Transfer Tokenization Burning tGOLD 0.18% 0.5% 1% tSILVER 0.18% 1% 2% tPLATINUM 0.18% 1% 2%

These fees are proportionally distributed to AurusX stakers and Bullion Providers each month. Ecosystem rewards progressively increase parallel to the number of precious metals tokenized and transferred.

Bullion Providers

Brokers and refineries that tokenize gold, silver and platinum to create tokens. The more metals they tokenize, the more rewards accumulated due to tokenization fees.

Distributors

Precious metals businesses around the world that buy and sell tokens globally. Fees are accumulated for the ecosystem as these players execute token transactions.

Decentralized exchanges

DeFi platforms operate on-chain, meaning every swap, liquidity provision and staking operation will collect transaction fees that are redistributed as rewards.

Token holders

Transactions and transfers of precious metals tokens involve a modest fee. The more transactions happen, the more the rewards to be accumulated for distribution.

Pro tip

Benefit from the trading activity of precious metals with AurusX

AurusX derives its value from the transactional volume of Aurus precious metal tokens: tGOLD, tSILVER, and tPLATINUM.

Earn a steady stream of rewards in crypto backed by gold, silver and platinum, regardless of market direction.

AurusX benefits from the price volatility of precious metals, making it an excellent portfolio diversifier.

Welcome to Aurus. Your journey begins now.

Download the Aurus Mobile App

Create a wallet and start accumulating crypto backed by gold, silver, and platinum in seconds.

Precious metals tokens

Buy, store, and trade precious metals easily, anytime, anywhere.

Aurus Vault Card

1:1 precious metal-backed tokens.

Aurus tokens are backed by precious metals sourced from LBMA, DMCC and LPPM accredited refineries. The underlying bullions are safely stored in partnered vaults in Montreal, London, Zurich, Istanbul, and Singapore. View the custodial audit reports to see how your gold, silver, or platinum is stored in some of the most secure vaults in the world.

Maximize your precious metals rewards with AurusX

Learn more about the benefits of AurusX (AX). Download the AurusX brochure for free.