Why Gold-Backed Tokens Are the Perfect Solution for Gold Investors in 2022

Learn more about Aurus and how it will revolutionize gold investing with blockchain technology. Now anyone can easily diversify their portfolio and benefit from the gold as the ultimate store of value and safe-haven asset.

Share article:

Aurus is a new platform that merges the world of digital currencies with traditional precious metals investing. Tokenization makes it possible to invest in the safety and security of gold without the traditional drawbacks of limited transportability or high storage costs.

With Aurus, investors can buy, sell, and trade gold in a secure and easy-to-use platform. AurusGOLD is a highly portable, transferable, and liquid digital asset that offers investors of any size a convenient and cost-effective alternative digital alternative to physical gold bullion products. So, if you’re looking for a safe and reliable way to invest in gold, Aurus is the perfect option!

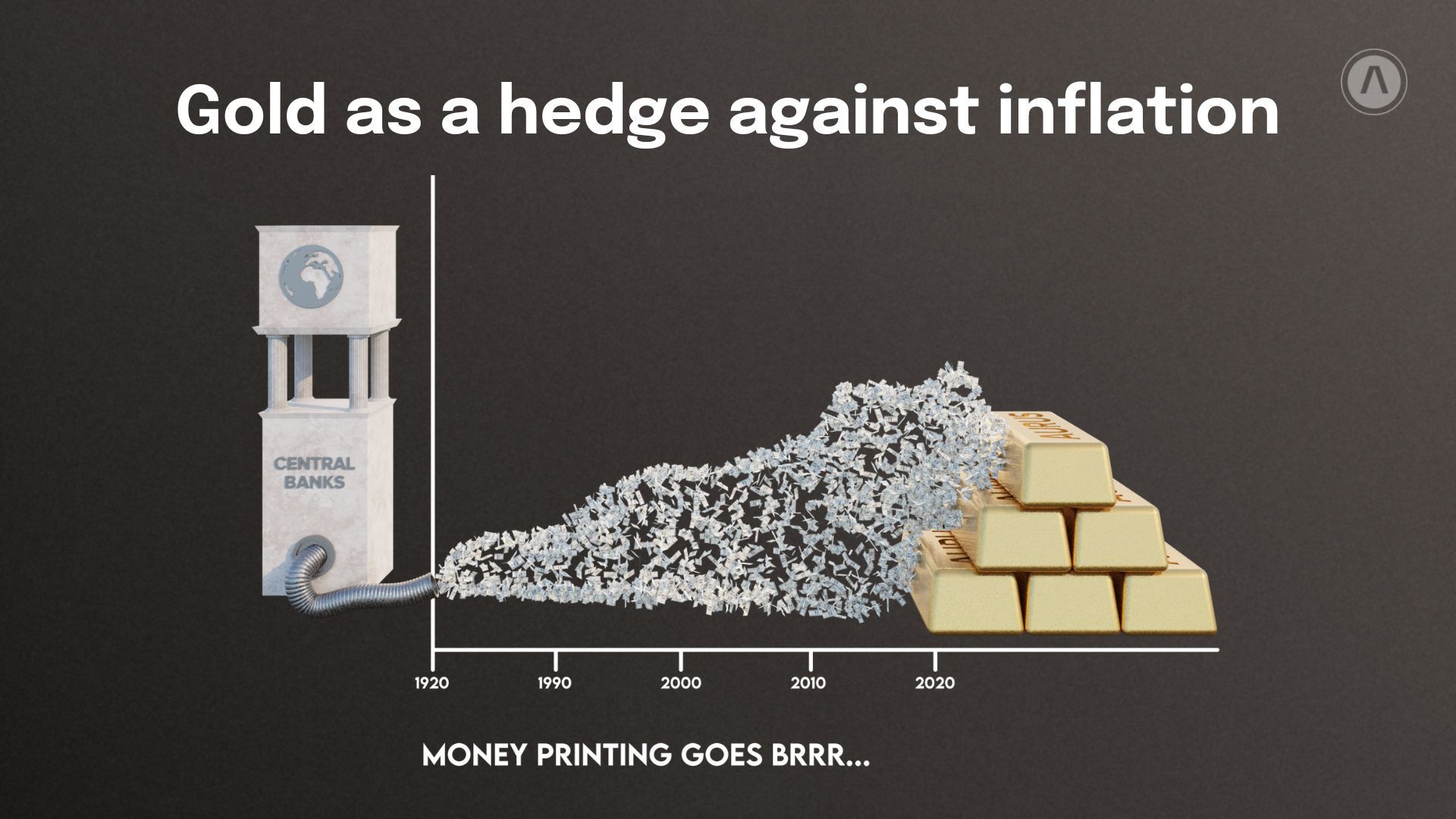

Gold as a Long-Term Hedge Against Inflation

Most investment experts say that gold should be a part of a healthy investment portfolio. An argument that they use to support this opinion is that gold is a hedge against runaway inflation. Inflation is the investor's archenemy, its progressive increase in prices of goods and services over time eating away their gains.

The IMF describes inflation as a broad measure that leads to an increased cost of living or items in a country. The rising costs of everyday goods and services such as haircuts or soft drinks point to escalating inflation levels. As per the international financial institution," inflation represents how much more expensive the relevant set of goods and services has become over a certain period, most commonly a year."

For this reason, gold rallied as inflation rose to alarming levels in early 2022, pushing the gold per ounce price to $2000 in early March. Runway inflation reared its head following escalating tensions from the Russia-Ukraine war. As a result, the high cost of items escalated as the US Fed ruled out a 50 bps interest hike.

Consequently, the US annual inflation rose to 8.6% in that period, the highest inflation level since December 1981. Elsewhere in Germany, the annual inflation level rose to 40-year highs as oil and gas products prices soared to new highs.

Consequently, the US annual inflation rose to 8.6% in that period, the highest inflation level since December 1981. Elsewhere in Germany, the annual inflation level rose to 40-year highs as oil and gas products prices soared to new highs.

The German consumer price index (CPI) rose to 7.3% from 5.1% in February as businesses passed these high energy costs over to consumers.

"Welcome back to the 1970s! At least as far as food, goods, and energy prices are concerned," warned German bankers asking the European Central Bank to take a tougher monetary tightening stance.

"The more protracted this period of continuing shocks, the more likely it becomes that economies suffer something like the 1970s experience," warned Maurice Obstfeld, former IMF chief economist.

In response to these fears, the European Central Bank fast-tracked the wind-down of its monetary stimulus, a sign that the developing runaway inflation rates indeed spooked it. On the other hand, the US Fed delivered a massive rate hike in June in its battle against inflation.

The three-quarters of a percentage point interest rate hike is the largest the Fed has set in 28 years, following a half-point rise in May and a quarter-point hike in March. These actions lowered fears of runaway inflation and raised the opportunity costs of holding non-yielding gold.

Consequently, the shiny yellow metal's prices retail at the relatively neutral $1800 an ounce territory and could slip further as central banks engineers more impactful soft landings for their economies.

Their actions could further allay short-term inflation and increase yields and rates, putting more pressure on bullion prices. That said, while these actions may neutralize the short-term symptoms of inflation, they in no way cauterize the effects of the expansion of the supply of money, the actual cause of price inflation.

Central banks are printing money faster than economies can produce goods and services, increasing-price inflation. As an illustration, the US money supply grew by $831 billion between 1981 and August 2008.

Then, the Fed released $1.6 trillion to the economy in three months following the Lehman Brothers' bankruptcy filing via its 'quantitative easing (QE)’ process. The expansionary monetary policy pushed the US M2 money supply by 27% in 2020 and 2021. It is the highest and fastest increase in dollars in circulation in America’s history.

The incredible money supply expansion leaks into the global economy, creating property market asset bubbles and rising prices for goods and services. But unfortunately, incomes do not increase in tandem with these events.

To this end, an ounce of gold worth $35 in the 40s saved in a vault would be worth a lot more in 2022. If you open that vault today, your ounce of gold will be worth $1800, while your $35 notes can only purchase negligible amounts of goods or services.

Other Benefits of Investing in Gold

Gold preserves its value over long periods better than fiat. The value of this precious metal is not subject to the central bank's quantitative easing policies. You now need more fiat to purchase an ounce of gold as the value of printed cash depreciates over time.

Consequently, gold is a long-term safe-haven asset. It, however, could yield negative returns for investors who enter the market during inflationary periods when there is a bullish sentiment. Over long periods, however, it will generate above-average returns.

To illustrate this point, gold had a 35% return between 1973 and 1979. That said, buyers who entered the market between 1988 and 1991 had a negative 7.6% yield. Nevertheless, long-term holders have had their bullion price rise from lows of $440 per ounce in 2000 to its current $1800 average.

Besides its strategic inflation hedge benefits, there are many other benefits of gold in your investment portfolio. First, gold is the only private form of investment today. Unlike real estate or stocks that require ownership registration, you do not need to register gold ownership. Consequently, you can purchase gold bullion as a private store of wealth and transfer it to your loved one tax-free as per the 7-year inheritance tax rule.

Furthermore, some physical gold investment returns are tax-free. That being the case, gold is also one of the best-performing assets of the 21st century. To illustrate this point, UK gold investment returns have grown over 10% per year since the 2000s, while the FSE 100 returns have grown by 4.1%.

Additionally, your savings will rest outside the banking system when you invest in gold. Because of this, your life savings will not suffer exposure to counterparty risks. Gold is also an excellent investment asset because it is a universally recognized store of value and medium of exchange.

Consequently, you can liquidate it worldwide as payment for goods or services. Last but not least, gold is rare and has a finite supply. It will therefore become more valuable over time.

Benefits of Gold-Backed Crypto vs. Physical Gold

On the flip side, gold is an expensive asset. Due to its pricey and rare status, you will have difficulty purchasing significant amounts of gold at a go. When you buy gold, you will incur its storage, security, and insurance costs, increasing the complexity of gold investing.

If you choose to store your gold bars, coins, or jewelry at home, you must purchase a vault and pay for transportation to and from your vault. Gold transportation depends on the weight of your assets and travel distance.

Then, while gold is universally acceptable, it has low levels of liquidity. Therefore, you will need to scour the marketplace looking for genuine gold buyers, arrange transportation and work out a good deal with them before selling your gold.

The gold purchase process is also complex. First, you must make sure you are purchasing genuine bullion, not painted lead. Fraudulent sellers often sell incorrect gold purity at higher-than-normal prices. Then, if you buy gold for short-term gains, you could lose your profits due to volatility.

Gold, like cryptocurrency, is a speculative asset that acquires its value from its rare quality and limited supply. On top of that, this precious yellow metal does not bear yield and, in some cases, could be liable to taxation. This is why savvy gold investors purchase gold-backed crypto tokens like AurusGOLD (AWG) in the place of physical gold.

The Benefits of Gold-Backed Crypto: AurusGOLD.

Commodity-backed stablecoins such as AurusGOLD are growing in popularity in crypto circles since they are less volatile than mainstream cryptocurrencies and, therefore, a stable store of value. You can redeem your gold-backed crypto tokens for an amount of gold similar to the 1:1 redemption status of USD or Euro pegged stablecoins such as PAR or USDC. In the case of AurusGOLD, one token represents one gram of gold.

When you purchase AurusGOLD, you hold a token with the same value as gold in your digital wallet. Its price tracks the actual price of gold, and you own physical gold without the added complexity and costs of physically holding on to it.

When you purchase AurusGOLD, you hold a token with the same value as gold in your digital wallet. Its price tracks the actual price of gold, and you own physical gold without the added complexity and costs of physically holding on to it.

Gold-backed cryptocurrencies are more liquid and have more utility. As a result, they are a less complex route to commodity trading.

AurusDeFi (AWX) is the reward-bearing component of the Aurus ecosystem, a decentralized fee-based protocol that generates progressive rewards based on the transactional activity within the Aurus ecosystem. Rewards can be claimed in tokenized gold, silver, and platinum via the Aurus Mobile App. A new way to passively grow your precious metal holdings.

AurusDeFi is also a governance token, giving you the right to vote on proposals and influence the governance of the entire Aurus ecosystem.

The Aurus Ecosystem encompasses a unique collaborative model from which traditional precious metals industry players can benefit. Bullion refineries and dealers that want to venture into the digital asset space can leverage the Aurus blockchain protocol to mint their gold, silver, and platinum tokens to offer a new digital product and earn rewards. Some Aurus ecosystem precious metals tokenization partners include Aurica Metales, Aga Bullion, StoneX, and Direct Bullion. There is no better time to invest in gold, as experts raise the alarm over an inflation ‘time bomb’ that could be devastating to savers.

Join the tokenized precious metal investment movement today and lower your gold investment opportunity costs via Aurus gold-backed crypto tokens. Alternatively, become an Aurus partner and support the development and success of a self-sustaining crypto ecosystem that scales as more people invest, trade, and store Aurus's precious metal-backed tokens.

Follow Aurus: Website | Twitter | Telegram | LinkedIn | Youtube | Newsletter